|

Preliminary

Findings

Our

modeling systems have projected increasing demand for forest products

in North America that will be severely dampened by the inability

to supply the raw timber resource in order to meet this demand.

Our analysis indicates future US structural changes in wood use

patterns, rising product prices, and higher profitability for some

producers and timber owners.

Key

Findings

- Past relationships

between the solid wood consuming sectors, such as housing starts,

and key macroeconomic demand drivers, such as GDP, will change

as wood products prices become a significant factor in solid wood

products consumption.

- US softwood

timber harvest will decline significantly over our projection

period due to diminishing resource availability. Hardwood timber

harvests will increase.

- Canadian

timber harvests will reduce, wood products consumption will increase,

and lumber exports to the US will decline.

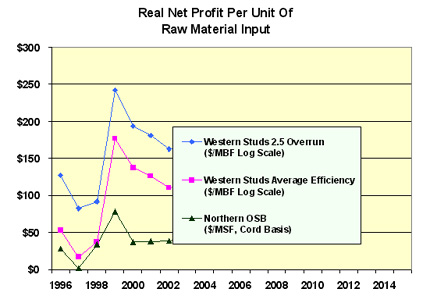

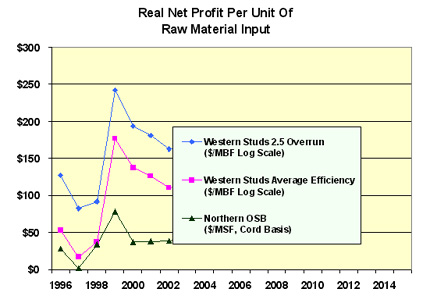

Paper and paperboard producers will experience increased real

costs of virgin fiber input while more efficient solid wood consuming

competitors will find increasing returns per unit of raw material

input.

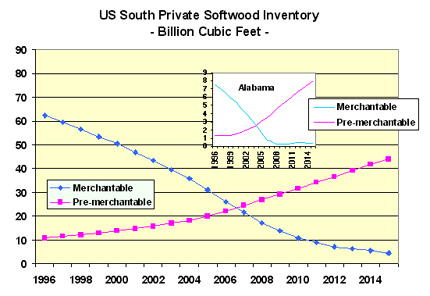

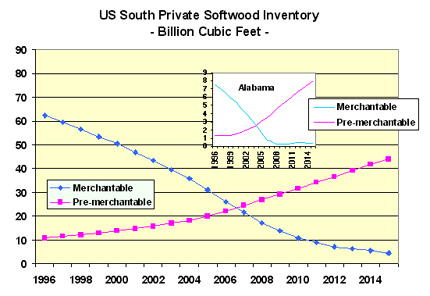

- The US South’s

merchantable softwood timber inventory declines from current levels

to harvesting only merchantable growth. Merchantable hardwood

timber inventory in both “soft” and “hard”

hardwoods will also decline.

Southern pre-merchantable timber inventory will tripple over our

projection; however, this volume is not a significant factor in

explaining stumpage prices.

- Softwood

sawtimber, pulpwood, and wood products prices will increase significantly

in real price during our projection period.

Lumber production will be resource constrained at levels substantially

below current output levels. Softwood plywood production will

Drop to less than one-half current production levels.

Raw material real breakeven margins, calculated at the average

efficiency and not pre-set margins, will reach historical highs.

Efficiency bands for raw material breakeven provide payback and

present value justification for financing capital improvements

Sample

Illustrations

|